- Discretionary management

- Following up on your investor profile

- Following up on your asset allocation

- Assessing internal and external solutions

- Volatility management

- Risk management

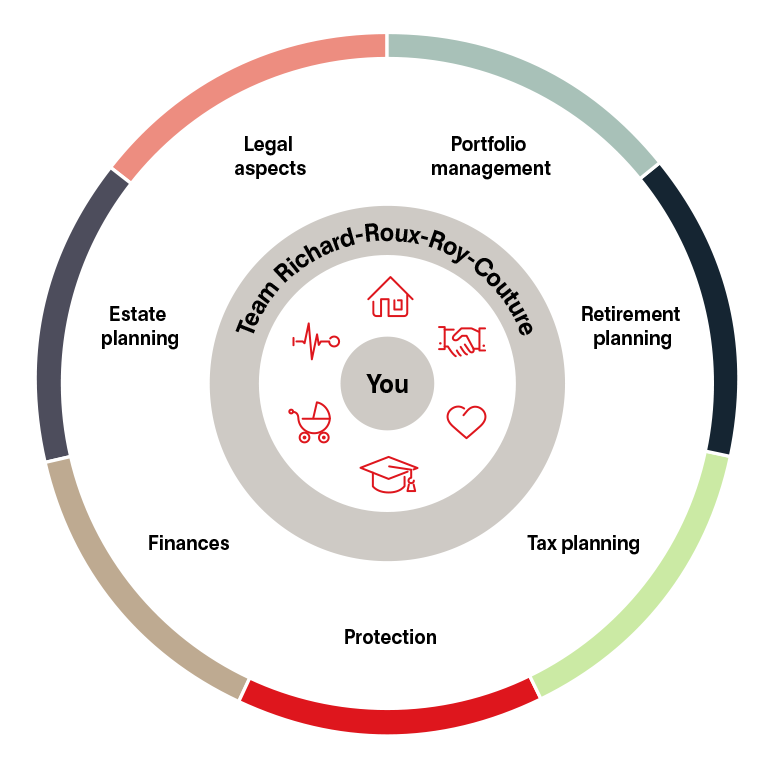

Solutions designed to meet your needs

We aim to make it easier for our clients to manage their finances and help them make decisions so they can focus on what matters most to them.

Simplifying your life

See all our areas of wealth management expertise

Supported by an internal network and experienced external partners, we can support you in the seven areas of financial planning. We review each of these areas periodically to make sure you can achieve your objectives.

Certain services are offered by third party specialists. *1, 2, 3

Do you have enough savings?

- Following up on your changing objectives

- Defining your retirement savings strategy

- Establishing your retirement income

- Updating your retirement plan

- Following up on your withdrawal strategy

- Group plans

Are you making the most of the tax accounts and strategies at your disposal?

- Optimizing investment income

- Year-end tax planning

- Income splitting strategy

- Optimizing your TFSA, RRSP, RESP, FHSA

- Collaborating with your accountant

What risks and blind spots should you consider?

- Life and disability insurance

- Critical illness insurance

- Estate planning strategy

- Professional needs

- Insured annuities

- Group insurance

Do you know your cost of living, now and in the future?

- Drawing up a budget

- Emergency fund

- Mortgage financing

- Line of credit

- Made-to-measure banking solutions

What do you want your legacy to be? Do you want to make gifts to your

heirs while you’re alive to ensure your wishes are respected?

- Wills

- Asset inventory

- Testamentary trust

- Legal guardian

- Philanthropy

Have you prepared things for your loved ones? Have you done what you can to simplify their lives?

- Protection mandates

- Powers of attorney

- Advance medical directives

- Protective trusts

- Corporate structure

The pillars of our portfolio management practice

Objective advice: Our team focuses on selecting the best financial products when building portfolios. We don’t have in-house products to sell.

Consolidate without putting all your eggs in the same basket: Asset consolidation makes it easier to diversify and monitor investment plans while reducing fees.

We favour active management combining passive and active solutions: When research shows that managers are not adding long-term value in a given market, we opt for index exchange-traded funds. When we see that they do make a difference, however, we use external fund managers instead of selecting individual stocks or investments.

A defensive approach: We avoid permanent losses and substantial drops.

A reliable approach: We strive to generate performance that is comparable to the market while taking the least possible risk to do so.

Choose discretionary management: This allows us to better execute and improve diversification while eliminating the emotional aspect of decision-making.

Personalized portfolios: We personalize your portfolio based on the importance you assign to tax efficiency, saving on fees, security and portfolio performance.

We’re here to simplify your life

We’ll draw up a clear, simple financial plan, where each decision is intended to achieve a specific goal. We aim to optimize your overall financial situation. In addition to managing your portfolio, we’ll consider all the areas of financial planning.

We’ll help you put things in perspective: Thanks to our proven institutional portfolio management approach, supported by research and empirical analyses, we can avoid being led astray by conflicting information.

We’ll help you access the resources you need to achieve your financial objectives, thanks to:

- Our team of professionals

- Our well-established firm

- Our reliable banking network

- Our insurance firm

- Our multidisciplinary network of external professionals (notary, tax expert, accountant)

- Financial Planners are authorized to act in the field of

Financial Planning. They exercise their duties for National Bank

Financial Inc., a financial planning firm.

- We

work closely with the Taxation, Retirement and Estate Planning Team

from National Bank Trust, made up of multidisciplinary experts who

provide knowledge and advice that complement our service offering.

These experts assist us in providing the best solutions for your

personal finances related to taxation, retirement and estate

planning.

- Insurance products and services are

provided by National Bank Insurance Firm (NBIF) or by NBF Financial

Services (NBFFS), as applicable. NBIF and NBFFS are not members of

Canadian Investor Protection Fund (CIPF). Insurance products are not

protected by CIPF.

- Financing solutions are

subject to credit approval by National bank.

- For details and conditions of the offer, please contact your advisor.